Finance

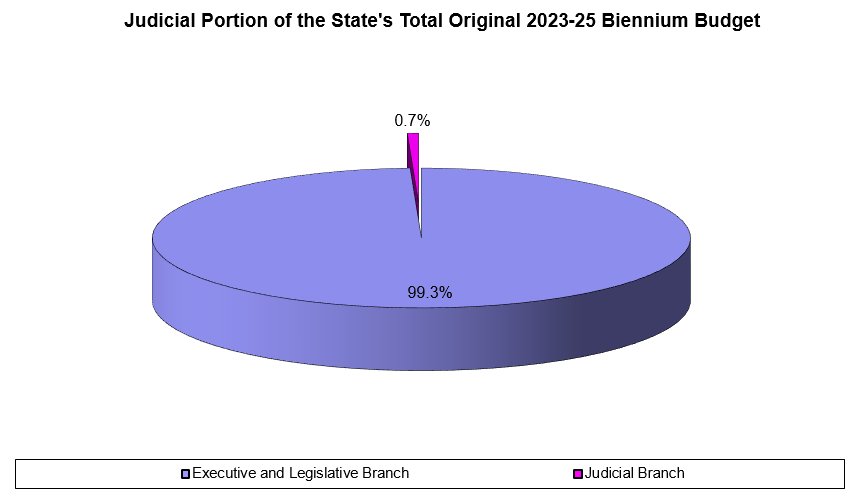

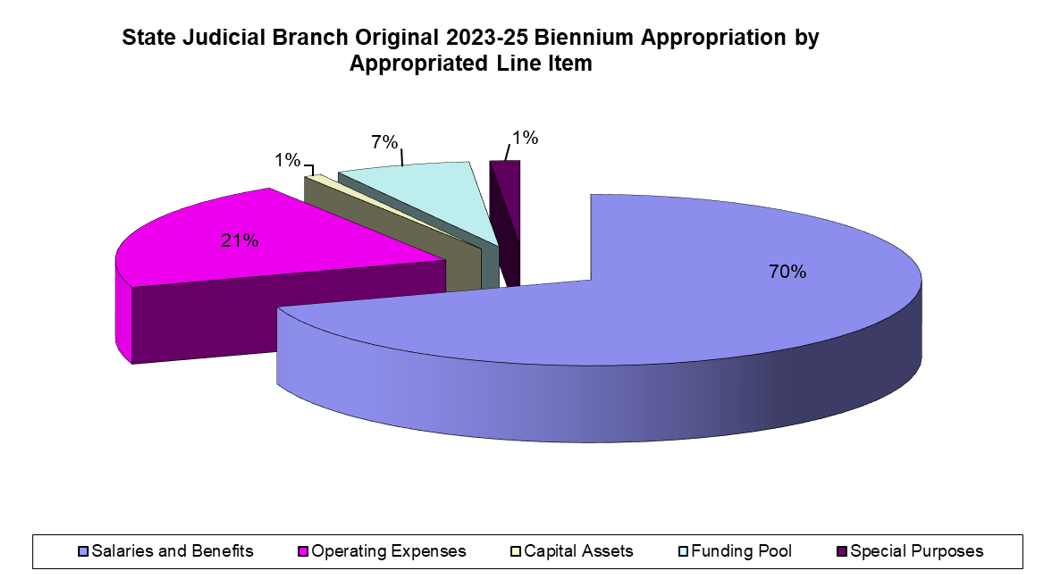

One of the primary functions of the office of state court administrator is to obtain adequate financial resources for judicial operations and to manage these resources.

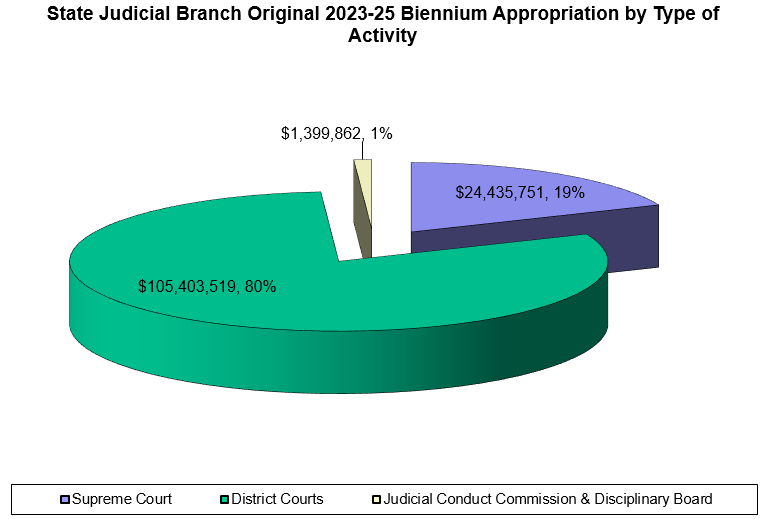

In viewing the judicial budget, it should be noted the state funds the Supreme Court, the Judicial Conduct Commission, approximately half of the expenses of the Disciplinary Board, and district court expenses, including 14 of the clerk of district court offices. The remaining clerk offices are funded by the state through a service contract. Municipal courts are funded by the municipalities they serve.

Court system budget

View expenditures on OMB's transparency site (select Agency-> Judiciary System)

Request for Proposals

RFPs issued by the courts can be viewed by clicking here.

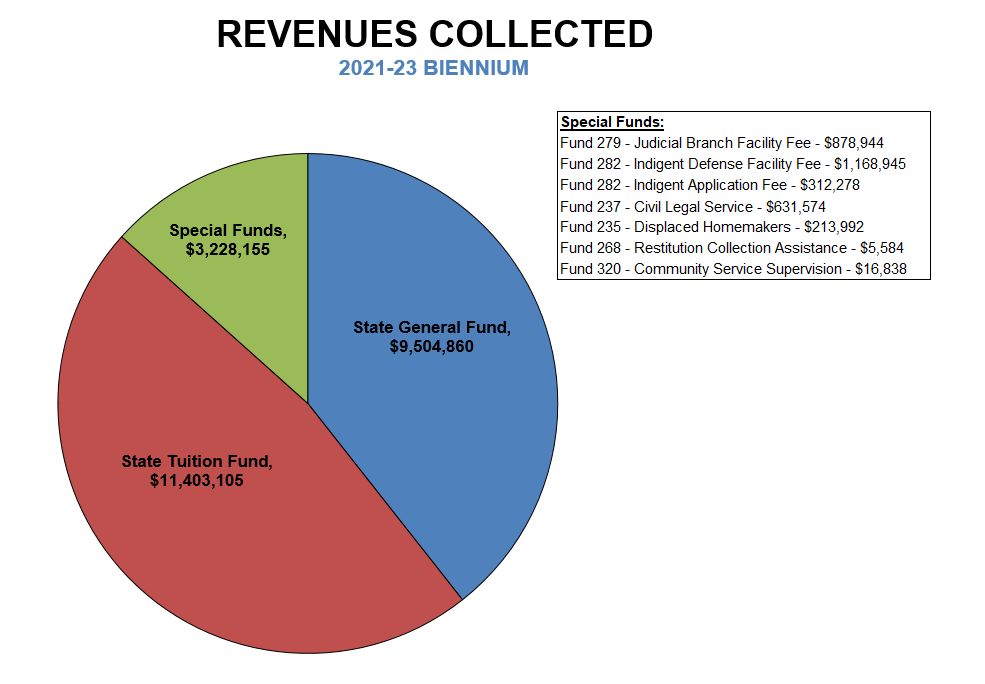

Revenues Collected and Disbursed

Collection Priority

Clerks will be required to apply funds received according to the following priorities:

- Restitution

- Digital Forensic Evidence Fee (not to exceed $100) [NDCC 29-26-22.4]

- Defense/Facility Administrative Fee ($100) [NDCC 29-26-22(2)]

- Victim/Witness Fee ($25) [NDCC 27-01-10(1)]

- Fines/Forfeitures (State Common School)

- Criminal/Court Administrative Fee [NDCC 20-26-22(1)]

- Check Collection Restitution Fee [NDCC 12.1-32-08(2)]

- Community Service Supervision Fee ($25) [NDCC 29-26-22(3)]

- City Transfer Cases

Revenues Owed

Accounts Receivables - Outstanding as of June 30, 2025

Tax offset/intercept

In accordance with NDCC 57-38.3 and Administrative Rule 55, refunds of state income taxes can be offset to pay court ordered fines, fees, and costs due the state on accounts that are delinquent by 90 days or more. The finance department of the State Court Administrator’s office coordinates with the North Dakota Office of the Tax Commissioner and the court’s Information Technology department to exchange information regarding individual delinquent accounts.

If your account with the court is delinquent it may be referred to the Office of the Tax Commissioner for collection through tax intercept. You will receive a notice from the State Court Administrator’s office.

If your taxes are intercepted to pay court fines, fees or costs, you will receive a notice from the Office of the Tax Commissioner that will include the amount of the intercept and the intercepting agency’s contact information.

- If you filed a single return, the funds collected from the Tax Commissioner will be applied to the balance you owe to the courts.

- If you filed a joint return, the amount intercepted will be held for 30 days pending notice to your spouse. Financial obligations imposed by the court are a penalty on the person convicted and are not a financial obligation against the spouse. A spouse will receive notice by mail of the tax intercept and have the opportunity to file a request for a hearing on the amount intercepted. The spouse may be entitled to a refund of the portion of intercepted money that was attributed to income they made.

You can find more information about what you owe using the court’s public search site and web payment guide.

You can also contact the Clerk of Court in the county where your case is filed or the State Court Administrator’s office at 328-1804.